Life Income Gifts: Secure Your Future, Secure Your Legacy

As we age and come to peace with the finite nature of our earthly lives, we begin to take inventory of all aspects of our being: Our health, our relationships, our finances, and, ultimately, the legacy that we leave behind when our time comes to pass.

Through this reflection we pinpoint our core values and determine how those things which we hold most dear might be reflected in our own estate plans. Often, this will come in the form of a legacy or planned gift to a charitable organization that mirrors those same core values.

At the same time, many who have a desire to support the charities they love beyond their lifetime also wrestle with the fear of outliving their assets. Charitable vehicles known as life income gifts can offer donors present-day tax benefits, provide a stream of income throughout their lifetime, and have a significant charitable impact at the time of their passing.

A life income gift is a gift arrangement in which the donor makes an irrevocable gift of cash or appreciated securities to a charitable organization. In exchange, the donor receives an immediate charitable deduction and an income interest for life or for a specified number of years. Following the death of the income beneficiaries or the close of the gift’s term, the remaining value of the gift is transferred to the charities specified by the donor when the gift was established.

The Episcopal Church Foundation (ECF) offers three types of life income gifts for donors who wish to benefit Episcopal entities (parishes, dioceses, and other Episcopal institutions) through their philanthropy.

Charitable Gift Annuities provide donors or other donor-designated beneficiaries with guaranteed fixed income for life. Charitable Gift Annuities can be funded with as little as $5,000. The minimum age to receive annuity payments is 55. However, payments may be deferred.

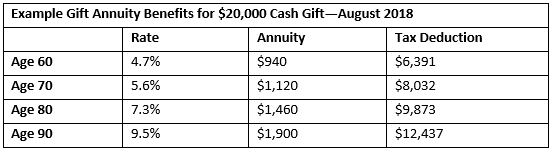

On July 1, 2018 suggested gift annuity rates were increased for the first time since January 2012. Suggested maximum rates are designed to produce a target charitable gift of 50% of the funds contributed at the start of the annuity. The table below illustrates sample rates for a $20,000 Charitable Gift Annuity funded with cash.

[Figures are sample rates for a single life annuity and are for illustrative purposes only. Tax deduction may vary. Always consult with your own tax advisors before making any gift.]

Charitable Remainder Trusts come in two varieties (Charitable Remainder Unitrust or Charitable Remainder Annuity Trust) and pay beneficiaries regular payouts either for a fixed period of up to twenty years or until the income beneficiary dies. Income is either a fixed dollar amount or a fixed percentage, depending on the type of trust.

In a Pooled Income Fund donor gifts are “pooled” with other gifts in an investment portfolio. Donors or other beneficiaries receive guaranteed income for life, although the amount will depend on the fund’s rate of return and will vary year-to-year. The Pooled Income Fund has a minimum contribution level of $2,500.

ECF is happy to speak with donors regarding their desire to establish a life income gift or other type of legacy gift. For more information on the various types of Life Income Gifts offered by ECF, please visit http://www.episcopalfoundation.org/programs/planned-giving/types or contact us at 800-697-2858.

Donors are strongly urged to consult their own counsel and advisors about the risks and financial and tax consequences of any proposed gift.